£100 Billion....

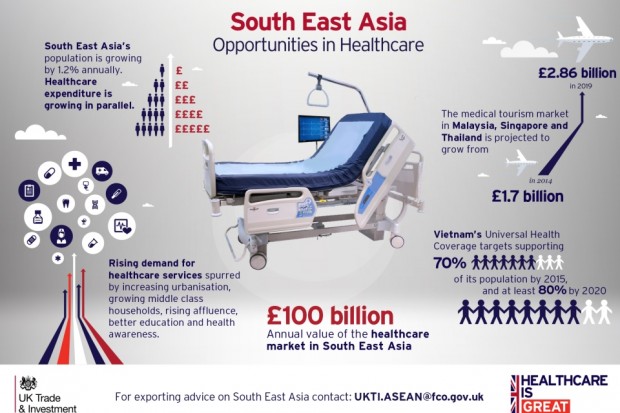

That’s the value of the annual opportunity in the healthcare market in ASEAN!

Not many people know this, or that the ASEAN region offers a good fit to the wealth of innovation that regularly emerges from the UK’s Healthcare and Life Sciences sectors.

The Association of Southeast Asian Nations (ASEAN) is a political and economic organisation comprising 10 countries: Brunei, Burma, Cambodia, Indonesia, Laos, Malaysia, Singapore, Thailand, The Philippines and Vietnam. All quite different in terms of size, population, and rate of economic growth, yet when taken collectively, it offers a region of growing opportunity, which every export-oriented UK company would find worthwhile to consider.

ASEAN’s population of 620 million is not insignificant. It is the third largest after China and India, and accounts for 8.6% of the global population. With a combined GDP of US$2.4 trillion in 2013, growing at an average annual rate of 5.6%, the region’s economic growth is outpacing many other regional and global economies.

ASEAN offers significant opportunities in the healthcare sector for several compelling reasons. There’s a rising demand for healthcare services spurred by increasing urbanisation, growing middle class households, rising affluence, better education, and health awareness.

The region’s population is growing at 1.2% annually, and total healthcare expenditure is growing in parallel. It is estimated to have grown from US$69 billion in 2010 to US$111 billion in 2014 and expected to reach US$150 billion by 2016.

Rapidly ageing populations, especially in Singapore and Thailand, rising prevalence of chronic diseases, and government initiatives to improve access to healthcare services are the key drivers for the overall public healthcare spending in SEA.

The medical tourism market in Malaysia, Singapore and Thailand is projected to grow from US $2.64 billion in 2014 to US $4.48 billion in 2019, as they offer quality care at affordable prices for international patients.

When you look deeper, there are diverse opportunities in the region, as countries initiate healthcare reforms and long term plans to boost their healthcare provision:

- In January 2014, the Indonesian government launched its national health insurance programme to achieve universal health insurance coverage in Indonesia by 2019.

- In 2013, the Philippines introduced the Universal Health Care Act to ensure that all Filipinos, especially the poor, receive health insurance coverage.

- In 2012, Singapore rolled out the Healthcare 2020 Masterplan that aims to double the government’s healthcare expenditure and expand hospital, primary, specialist and aged care infrastructure.

- In 2010, Malaysia launched the Economic Transformation Programme to reach developed nation status by 2020.

- Healthcare is one of the 12 National Key Economic Areas prioritised by the government to encourage private investment.

- Vietnam’s Universal Health Coverage targets covering 64.1 million people, or 70% of its population, by 2015, and at least 77.2 million (80%) by 2020.

When I consider the UK’s healthcare strengths across the sector, from design and build to equipping, and the breadth of innovation coming from universities and the NHS, there is a fit between UK strengths and the wide ranging opportunities in ASEAN..

Organisations offering hospital design and management, healthcare training and education, technology solutions to increase efficiencies and cost savings in all healthcare settings, should take a close look at ASEAN. Other opportunities include development of aged care facilities, and products and services for the elderly, Healthcare IT/Telehealth/E-health, and cost effective and value added medical devices, amongst others. Singapore, for instance, as a respected referral centre, is keen to trial innovative products and solutions, which can then be moved easily into other markets.

UK successes in the region include GSK, Astra Zeneca, Smith & Nephew, Smiths Medical, Vernacare, Dortek, Bioquell, Eschmann, Randox Laboratories, Bio-Mist, Stannah Stairlifts, Swann-Morton, Sidhil, Heartsine, Portex, Pneupac, Dentafix, Accoson, Keeler, Surgical Innovations, Haigh Engineering, Intersurgical, Strakstrom, and many others.

There are recent developments that will make it even easier for more British businesses to access the ASEAN healthcare market.

The ASEAN Economic Community (AEC) will come into force by the end of 2015. This will help drive regional economic integration and the free movement of goods, services, investments and skilled manpower. Healthcare, e-commerce, logistics and tourism are priority sectors for liberalisation.

In September 2014, all 10 member countries of ASEAN signed the ASEAN Medical Device Directive (AMDD) to implement a harmonised medical device registration framework that will make it easier for foreign companies to enter ASEAN medical device market.

To help the UK healthcare industry consider ASEAN as a region, and to support their first steps here, UKTI Healthcare leads in all the 10 Posts have formed a virtual team. I am pleased to be the initial point of contact for UK companies and connect you to colleagues, who are experts in their respective markets, to help you develop your business in this region.

For advice on exporting to South East Asia contact UKTI.ASEAN@fco.gov.uk